6 Years And Counting!

Happy 6th Anniversary to US!

It’s hard to believe it was only six short years ago when Brian Whitta opened our company as Flag City REALTORS® on May 1, 2019. We opened in a hurry because the company Brian had been affiliated with announced its closure rather abruptly, and in a period of about six weeks, we made arrangements for an office space, had a logo designed and trademarked, got all of the technology and infrastructure launched and away we went!

Working 12-16 hours a day to launch a brokerage is not for the faint of heart!

In such a short period of time, we have grown not only in the number of agents affiliated with the company, but in transaction volume, and through being recruited to join the premier real estate network of Coldwell Banker in 2022.

What’s the best part? We are STILL growing!

We have many agents working through their courses, several others considering joining us from competing brokerages, and we will continue to be good stewards of the trust placed in us both here, and around NW Ohio. We are proud to serve residential and commercial needs, including relocation services!

If you are considering a career move, perhaps we are the right fit for you! And if you are considering the purchase or sale of real estate, we would love to help you achieve your goals. Join all of these satisfied clients!

2 Reasons the Housing Market Won’t Crash

Two Reasons Why the Housing Market Won’t Crash

You may have heard chatter recently about the economy and talk about a possible recession. It’s no surprise that kind of noise gets some people worried about a housing market crash. Maybe you’re one of them. But here’s the good news – there’s no need to panic. The housing market is not set up for a crash right now.

Real estate journalist Michele Lerner says:

“A housing market crash happens when home values plummet due to a lack of demand for homes or an oversupply.”

With that definition in mind, here are two reasons why this just isn’t on the horizon.

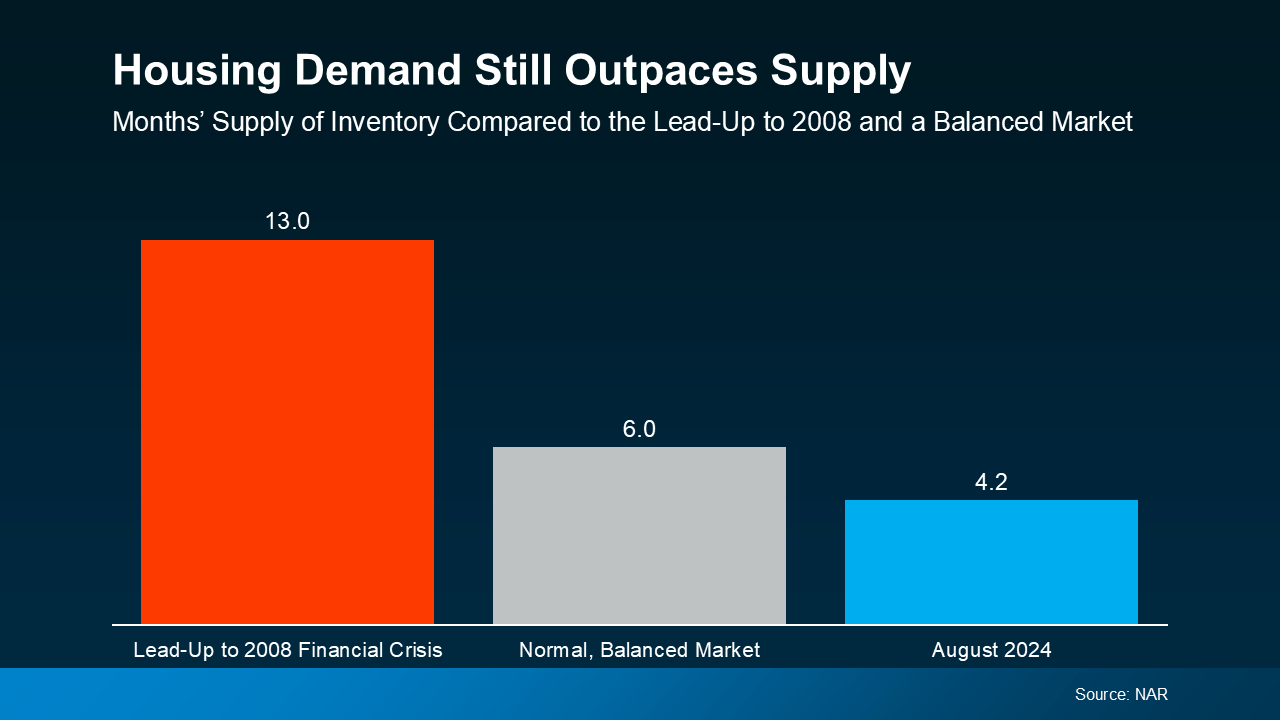

1. Demand for Homes Is Higher than Supply

One of the biggest reasons the housing market crashed back in 2008 was an oversupply of homes. Today, though, it’s a very different story.

It’s a general rule of thumb that a market where supply and demand are balanced has a six-month supply of homes. A higher number means supply outpaces demand, and a lower number means demand outpaces supply. The graph below uses data from NAR to put today’s situation into context:

The graph compares housing supply during three different periods of time. The red bar shows there were 13 months of supply before the 2008 crisis, which was far too much. The gray bar shows a balanced market with six months of supply, for context. And the blue bar shows there are only 4.2 months of supply today.

The graph compares housing supply during three different periods of time. The red bar shows there were 13 months of supply before the 2008 crisis, which was far too much. The gray bar shows a balanced market with six months of supply, for context. And the blue bar shows there are only 4.2 months of supply today.

Put simply, there are more people who want to buy homes than there are homes available to buy right now. So, demand is greater than supply. When that happens, home prices stay steady or rise – the opposite of a housing market crash.

It’s important to note that inventory levels differ from market to market. Some areas may be more balanced, while a few could have a slight oversupply, which can impact prices locally. However, most markets continue to experience a shortage of homes.

Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says:

“We simply don’t have enough inventory. Will some markets see a price decline? Yes. [But] with the supply not being there, the repeat of a 30 percent price decline is highly, highly unlikely.”

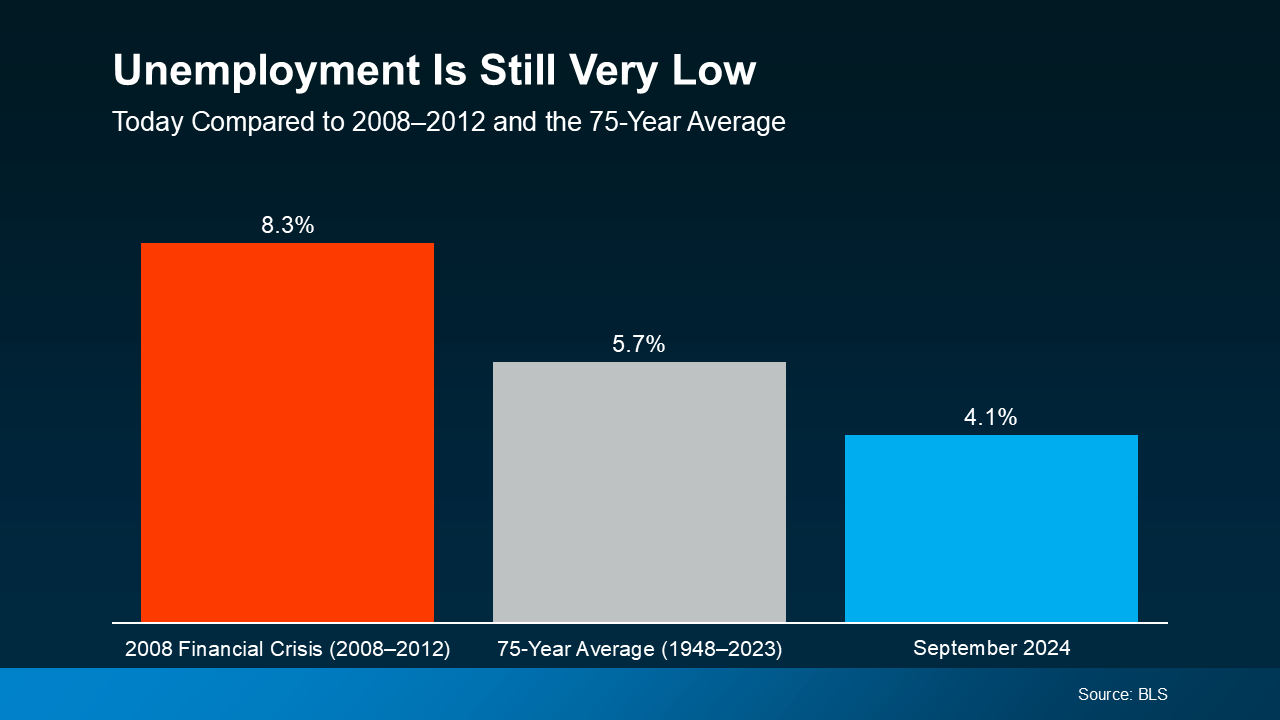

2. Unemployment Is Still Low

When people are unemployed, they’re more likely to have trouble making their mortgage payments and may be forced to sell or face foreclosure. That was a big problem during the 2008 financial crisis. Today, the employment situation is much more stable (see graph below):

Again, this graph shows three different periods of time, but this one is the unemployment rate. The red bar represents the 2008 financial crisis when unemployment was very high at 8.3%. The gray bar shows the 75-year average of 5.7%. And the blue bar shows the unemployment rate today, and it’s much lower at just 4.1%.

Again, this graph shows three different periods of time, but this one is the unemployment rate. The red bar represents the 2008 financial crisis when unemployment was very high at 8.3%. The gray bar shows the 75-year average of 5.7%. And the blue bar shows the unemployment rate today, and it’s much lower at just 4.1%.

Right now, people are working, earning an income, and making their mortgage payments. That’s one reason why the wave of foreclosures that happened in 2008 isn’t going to happen again this time. Plus, since so many people are employed right now, many are actually in a position to buy a home, and this demand keeps upward pressure on prices.

Today’s Housing Market Is Stronger than in 2008

While it’s understandable to be concerned when you hear talk of a recession and economic uncertainty, but know this: the housing market is in a much better place than it was in 2008. According to Rick Sharga, Founder and CEO at CJ Patrick Company:

“Literally everything is different about today’s housing market dynamics than the conditions that led to the housing crisis.”

Demand for homes still outpaces supply, and unemployment remains low. And these are two key factors that will help prevent the housing market from crashing any time soon.

Bottom Line

The housing market is doing a lot better than it was in 2008, but it’s important to remember that real estate is very local.

So, it’s always a good idea to stay informed about our specific market. If you have any questions or want to discuss how these factors are playing out in our area, feel free to reach out.

Happy Birthday, Coldwell Banker!

Legacy of Trust

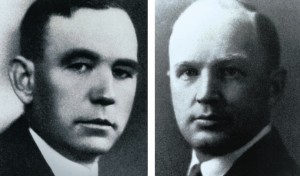

A young real estate agent, named Colbert Coldwell, started a company that would stand the test of time for more than a century. Two World Wars, the Great Depression and countless economic changes couldn’t stop what Coldwell started.

Colbert Coldwell and Arthur Banker, the founders of Coldwell Banker Real Estate

On August 27, 1906, something remarkable happened. A young real estate agent, named Colbert Coldwell, started a company that would stand the test of time for more than a century. Two World Wars, the Great Depression and countless economic challenges, including recent years, couldn’t stop what Coldwell started.

Why? In a word, trust.

It’s a term that’s frequently thrown about in the corporate world today, more often than not as an advertising slogan originating from a board room or agency rather than truly earned by reputation. But trust is legitimate when speaking of Coldwell Banker, and it’s absolutely instrumental to the longevity of the brand I know and love. Colbert Coldwell, in the midst of the chaos following the infamous San Francisco earthquake and fire in which dishonest real estate practices became the norm, envisioned an opportunity to build a company that would stand apart on a solid philosophy of putting the public’s interests first.

I love this quote from V.P. Brun (yes, that’s his name) which recounts the environment at the time of our founding:

“In those days, most real estate men had not heard the word “ethics”. If a good buy came in they bought it themselves and then peddled it off to a customer at a profit…Unscrupulous operators would tie up the property of an uninformed owner under a net contract then sell it at a tremendous profit to a buyer who had already agreed to pay twice or three times the contract price…That’s how things were then. But Colbert Coldwell had a unique idea. It soon became known on the street that Tucker, Lynch & Coldwell bought no real estate for their own account. They gave the buyer the benefit of all the profit and took only a commission”

— V. P. Brun

My Years with Coldwell, Banker & Company

The young Coldwell would elect long-term success based on principled business practices rather than short-term profits. So he put down in writing the exact services a customer could expect from his people and both parties would sign it like a contract. He also instituted a rule that lasted for decades that no agent working for Coldwell Banker Real Estate could own any other property beyond his or her primary residence. It was an open declaration that his firm would be held above all others.

The commitment he wrote with his customers still exists in an updated form today that we call the Coldwell Banker Seller Services Guarantee, and it’s the principles behind that guarantee that have been instilled in this company for over a century. Coldwell knew that trust was paramount in what was, and still is, a purchase that can change people’s lives.

As I travel around and meet thousands of Coldwell Banker agents ever year, I’m still amazed at the passion they have for their customers and the incredible stories they have of helping people find the home of their dreams. You’ll say I’m biased, which may be true, when I talk about Coldwell Banker agents being the best in the business, but you have to admit there’s something special about a real estate company that has managed to be so successful for well over 100 years while continuing to always keep the customer first in the transaction. And in a world in which every daily paper brings another reminder of yet another company losing sight of the importance of business ethics, Coldwell Banker professionals should take great pride in knowing it is the very thread that holds us together.

It all goes back to trust. It’s part of our brand’s DNA. Over these many years virtually millions of people have trusted Coldwell Banker agents with the most important investment they will every make…owning a home.

Mr. Huskey is the former President and CEO for Coldwell Banker Real Estate LLC. Budge grew up in a real estate family in Florida, where his father was a broker for 60 years, and he began his real estate career as an agent in 1984 in the Orlando area. Budge has served in a variety of roles over the course of his real estate career, including Branch Manager, President and COO with Coldwell Banker Residential Real Estate in Florida and Executive Vice President of NRT Southeast region. In 2010, he became President and COO of Coldwell Banker Real Estate and in 2013 was named President and CEO of the brand, overseeing all aspects of the international real estate franchise organization. He has served as a FAR and NAR Director and a member of NAR’s Strategic Planning Committee. Budge has routinely been sought out by the media on matters relating to the real estate industry.

5 THINGS TO DO BEFORE LOOKING FOR A HOME

Are you planning to buy a house this year? Whether you’re a first time buyer or just haven’t been looking for a home in a while, there’s a lot to do before you’re ready to start going on showings.

Even when the market is on the slow side, it’s important to be ready to move when you find the house. If you haven’t bought property before, there are some things you may not know to do. If it’s been a while since you bought your last home, there may be some things you forgot! This guide will give you the rundown on saving up to buy a house, getting lender-ready, and what to look for when buying a home.

Here are five things to do before you start looking for a home this year:

1. Find out where you’re at financially

Before you dive into listing photos and bedroom counts, it’s important to know how your current finances could affect the home buying process.

Know your credit situation

Knowing your credit score is the first step to understanding your home buying budget—and looking for the right loan. Although it’s possible to get an FHA loan with a score in the five hundreds, you’ll have a lot more options with a score of 620 or above. The higher, the better! If your score isn’t where you want it to be, take a good look at the report first to be sure everything is accurate. Then you can try to build credit by paying all of your bills on time or by keeping a credit card open, using less than 30 percent of its limit at any given time, and paying those purchases off quickly.

Calculate your DTI

In addition to your credit, lenders will look at your debt-to-income (DTI) ratio to assess what kind of loan you can afford. This number compares your monthly earnings to your debt, and unlike your credit score, you want it to be on the low side. To lower your DTI, avoid taking on new debt and work toward paying off any debt you already have. Aim for 35 percent or less, but some mortgage programs are fine with a DTI in the high thirties or even forties.

Come up with a budget

Taking all these things into consideration, look at your financials as a whole to decide what you’ll be able to spend on a house. An online mortgage calculator will give you a rough idea of your monthly payment based on the total mortgage amount, the interest rate, and the mortgage period. You may not know all of these factors right now, so play around with the numbers and look at your options.

You can also use the “maximum loan” option on many of these calculators to put your desired monthly payment, interest rate, and mortgage period in and learn what mortgage you could afford based on those criteria.

2. Start saving

Once you have a clear idea of your current financial situation, it’s time to start saving up to buy a house! There are a lot of costs hiding in plain sight when it comes to looking for a home, so you should plan ahead for things like:

- The earnest money deposit—around one to three percent of the purchase price

- Inspections

- Your down payment—probably between 3.5 and twenty percent of the purchase price

- Home Insurance

- HOA fees

- Property taxes

- Overlap between your existing rent or mortgage payment and the new one

- Unexpected repairs and maintenance after you move in

3. Consider signing up for a homebuyer education course

If all this information is making your head spin, you don’t have to muddle through it alone. Homebuyer education courses are available both in person and online, and they will walk you through the whole thing step by step. Some lenders may even require a course like this for first time homebuyers. But even if they don’t, it’s a useful way to familiarize yourself with the first steps to buying a home.

4. Decide what you really want

Let’s fast forward now and pretend you’re all saved up and ready to take the plunge. It’s time to take a long look at your priorities.

This sounds like the “fun” step, but it’s actually a very important one. No two areas are exactly alike, so if you want a central, downtown location and a two-car garage, for example, you might have to choose which is the most important. Now is the time to start checking out listings online to see what things are going for in your area and what features you can reasonably expect.

A REALTOR® can help you with this part, and they can also show you the bigger picture. Do you care what school system you land in? Are you willing to live in a flood zone? They’ll help you ask the right questions.

5. Work on a mortgage plan

Congratulations! You’ve got your savings squared away and you know what you’re looking for in a home. The next step is to research your loan options. Here’s what you need to know:

There’s more than one option—a lot more

There are many different types of home loans and different lenders may handle some of them in their own ways, so don’t stop with the first option you see—there may be a better one out there!

Visit more than one lender and look through the final fees and costs of each one. There may be appraisal fees, background and credit check fees, or fees for document preparation included. This is not necessarily a red flag (The appraiser does have to get paid, after all!) but it’s something to be aware of as you compare your options.

Don’t skip preapproval

We’ll say it again: don’t skip preapproval. It isn’t necessarily a loan guarantee, but it does give you a leg up over other buyers who don’t have one. The application process involves showing your preferred lender documentation that supports your ability to pay the loan you’re asking for. Think payment histories, W-2 forms, and tax returns.

Don’t confuse this with a prequalification, which is an estimate of your loan eligibility based on your word; it’s not always verified the way a preapproval is.

Now go check out some listings!

Having your ducks in a row means you can sit back and enjoy the best part: looking at houses! When you find the one that’s right for you, your REALTOR® will be able to put together a stronger offer and do it more quickly because of all the legwork you did early on. Happy house hunting!

DO YOU NEED A ROOF REPLACEMENT OR A ROOF REPAIR?

Now that the snow has finally started to melt and the sun is showing its face again, you may be seeing your home with fresh eyes for the first time in quite a while. This is a time of year when many homeowners become aware of roofing issues that may have escaped their notice over the long winter.

Have those shingles always looked a little uneven?

And what are all those little granules coming out of the downspout over there?

If you’re wondering whether a total roof replacement is needed or if you just need a roof repair, here are some signs that will give you a good idea.

Drooping and sagging

The good news: minor sagging can be fixable when it is the result of small design flaws in the framing or too many layers of shingles. So it’s possible a roofing professional will be able to address the issue without giving you an entirely new roof. This is not an issue to put off, though. The sooner you take action, the better your chances.

The bad news: major roof drooping, sagging and waviness are strong indicators that your roof is at the end of its lifespan—especially if it’s starting to show its age in other ways too. It could also be a warning sign of rot caused by moisture, which could lead to big problems if left unchecked.

Age

Knowing when to replace your roof is a delicate process. You don’t want to pay for an overhaul if there are still a few years left in it, but you don’t want to wait for a major issue either. The materials that make up your roof will help to give you a rough idea:

- Wood shingles can last up to thirty years if they are being regularly inspected.

- Asphalt shingles, the most common roofing materials, can last anywhere from fifteen to thirty years.

- Architectural shingles are thicker and sometimes more aesthetically pleasing than other asphalt shingles, and often have a longer lifespan as well. They can last for twenty-five to thirty years.

- Clay tiles can last fifty years, which makes them well worth the higher investment you or the previous owner made on the front end.

- Metal roofing can vary depending on the type and thickness of the metal used. Lifespans range from a mere twenty years up to seventy or more!

- Slate can last over a hundred years if the rafters are strong enough to support them.

If you know that your roof is starting to near the end of its lifespan and you are starting to notice warning signs, it may be time to look at a roof replacement.

Moss and algae

Plant life may be picturesque on a forest floor, but it should never be allowed to grow on your roof. Moss and algae are synonymous with moisture, which is the last thing you want leaching through your shingles!

A small amount of growth may be no cause for concern if you address it right away. Scraping it by hand and washing away excess with a garden hose is the gentlest route. You can also try a moss control powder made from zinc sulfate. Once you’ve cleared the existing moss, keep branches trimmed away from your roof and regularly clean your gutters to keep it at bay. If moss is a big concern for you, there are zinc strips that you can apply to your roof each year to help with the problem.

In some cases, too much moss and/or algae means a full roof replacement. Roots may have made their way between shingles, causing buckling, loosening, and maybe even leaking. Be sure to discuss options with your local roofing professional to see how you can keep your new roof plant free.

Isolated damage

Don’t worry if you have a couple of missing shingles or even a small leak. It’s not uncommon to need minor repairs after a big storm or a run in with falling branches! If your roof is still relatively young, these repairs are short work for a roofing professional. The most important thing is to call before these small issues grow into something more serious!

If your flashing is showing wear (that’s the material sealing the openings in your roof around chimneys, gutters, etc.) it may be a matter of simply replacing your tar flashing with an updated metal flashing system.

A see-through attic

If you can see daylight streaming through the roof in your attic, it is rarely a good sign—particularly with asphalt shingles. If light can make it through, so can moisture. This does, however, make it easier to identify problem spots, which is always a good thing! As with the other issues on this list, if you are seeing light in an isolated spot, it may mean you just need a quick roof repair. If your attic is starting to remind you of disco night at the bowling alley, you may want to budget for a roof replacement.

Rogue shingle granules

If you’re finding more shingle granules than usual in your gutters or downspout, it could be an early sign that a roof replacement is in your future. Older roofs tend to shed more granules as they age. You can also look at the shingles themselves to see if the coloring has started to look inconsistent. If your roof is getting on in years and there’s evidence that the shingles are starting to wear thin, you may want to call a local roofing professional to come out and inspect it.

In fact, whether you think you need a quick and painless repair or are worried you’re headed for an entirely new roof, it’s always helpful to get a professional opinion. When it comes to your roof, it’s not just a matter of curb appeal; it’s about keeping your home safe, dry, and structurally sound. The superficial things you’ve noticed may be warning signs of a less obvious problem, or you might be pleasantly surprised at what can be fixed with the right knowledge and tools!

3.2.2021

6 THINGS REALTORS® OFFER THAT YOU CAN’T GET WITH A FSBO

Looking to buy or sell a home on a budget? Your first thought may be to cut out the REALTOR® and go it alone with a FSBO, or For Sale by Owner. After all, these days you can find anything you need to know on the internet, right? Not exactly.

Look at it this way: If you wanted to know where something was in a store, you’d ask an associate. If you had questions while shopping online, you’d probably use that handy customer service chat feature. So why would you try to navigate one of the biggest investments of your life without a professional backing you up? There are a lot of things REALTORS® offer that a FSBO experience just can’t. You may even find that using a REALTOR® turns out to be more cost efficient in the end! From an easier overall experience to inside info you can’t find on Trulia or Zillow, here are six things your REALTOR® brings to the table that you won’t get with a FSBO.

1. Convenience

Buying—or selling—a house is a lot more time consuming than most people realize. When you’re selling, there’s a lot of invisible work to do on the front end. When buying, it’s important to make sure your ducks are in a row financially before you start seeing properties in person. Buyers will have dozens, sometimes hundreds, of potential properties to sift through. Sellers have to organize showings and escort interested parties around while answering their questions. Your REALTOR® can not only narrow down your search to properties that fit your needs but research comparable sales (or comps). This will make sure the price is right before you get in too deep. They can also facilitate showings so you aren’t tied to the phone.

2. Connections

Professional networks are strong in real estate. A good REALTOR® will be able to recommend local bankers, inspectors, contractors, real estate photographers, cleaning companies…the list goes on and on. It’s also highly likely that they will be familiar with other REALTORS® in the area, which helps with organizing showings, writing or responding to counteroffers, and more. An established REALTOR® will already have a platform, as well, which makes it easier to get the word out on a property you want to sell. Their website and social media already have followers who pop in specifically to see what’s on the market.

REALTORS® also have access to properties you won’t find on websites like Trulia, Zillow, and Realtor.com. They can use the MLS to see properties your internet search won’t bring up, and possibly find more detailed information about properties you like. The MLS is more accurate and reliable than generic listing sites, and it can’t be accessed by just anyone.

3. Expertise

Realtors in Ohio are required to complete thirty hours of professional development coursework every three years, so they are well versed on developments in the real estate industry. They know their area like the back of their hand and can point out pitfalls, alternatives, and bonuses that may never have occurred to you alone. In addition, they are used to the complex paperwork and legal requirements you’ll need to navigate. Multi-page purchase agreements, addendums, and the many rules that go along with them are not to be taken lightly. Your REALTOR® will be able to walk you through these documents so that you not only do them correctly, but understand what they mean.

4. Loyalty

Your REALTOR® stays with you throughout the process. For sellers, they start with helping you stage the property, advertise it, and find the offer that will give you the best ultimate outcome. A buyer’s agent will answer your questions about the properties you see, help you strategize and write a strong offer, and possibly sit in on inspections. It is their fiduciary duty to put the client’s needs first. That means it’s not only in their best interest to keep you happy, but it’s their legal responsibility to keep your private information confidential. There’s no guarantee of confidentiality when it comes to a FSBO!

We can even take it a step further. Flag City REALTORS® (and many other brokerages and agents nationwide) are heavily involved in consumer rights at the local and national levels. They dedicate their time, and in some cases, their own money, to promoting fair public policies related to homeownership, regardless of which side of the aisle a political candidate sits on. That means that even after—and well before—your closing documents are signed, your REALTOR® should be working toward a better and fairer homeowning experience for you.

5. Perspective

When it comes to real estate, and home buying in particular, buyers and sellers sometimes need help to stay objective. There may be a lot of emotion tied to this decision, but a REALTOR® can offer perspective, especially during negotiations.

As a buyer, you’re probably thinking mostly of your “wants” and your “don’t wants,” but your REALTOR® is looking at the property as a whole. They know to look into things like school zones, flood zones, noise pollution, and HOA requirements, in addition to basics like the number of bedrooms or the size of the yard. Sellers, on the other hand, may not have a good idea of what will appeal to the market. Seller’s agents are skilled at adding curb appeal and can give you pointers on staging the property to its best advantage.

6. Possibly, a better deal!

If you are a seller planning to go the FSBO route to save money, you could end up doing just the opposite. The National Association of REALTORS® (NAR) has found that FSBO homes actually tend to sell for significantly less than their agent-assisted counterparts.

Buyers trying to save a dime should still consider a REALTOR® as well. In addition to having a savvy negotiator in your corner, it’s important to remember that, technically, a buyer’s agent doesn’t cost you a thing. Under normal circumstances, your buyer’s agent will be compensated by the seller. They share the commission the seller pays to the listing agent.

Most people who consider diving into real estate without a REALTOR® do so because they hope to save a little money during an already expensive process. However, using a REALTOR® could actually save money in the long run, and the benefits they offer are well worthwhile. Want to talk with one from our qualified team? You can get started here today!

12.30.2020

5 OVERLOOKED SPRING MAINTENANCE TASKS FOR HOMEOWNERS

For many households, spring cleaning is a ritual that marks the beginning of the warm weather months—and a fresh start after a winter holed up inside. You may be planning on cleaning out your closets, scrubbing out a few forgotten corners, and finally organizing the garage this year…but there are a few important spring maintenance tasks you may not have on your list. (Or maybe they are on your list, but always somehow land at the bottom.)

This year, we’ve got five often-overlooked spring maintenance tasks for you to put at the very top of your checklist. If you make these jobs a priority, they’ll make a big difference in keeping your home feeling clean and safe all year long. Stay with us all the way to the bottom for some bonus ideas you can read up on right here at FlagCity.com!

Check out your garden hose and sprinkler system

Step one to keep any sprinkler system in top shape? Don’t use it too early! Remember that the ground where your system is buried may not be completely thawed, just because everything on the surface is. It’s a good idea to do a quick dig to make sure the soil is free of frost so you don’t damage your pipes by running water through them too soon.

Next, look for any debris like small rocks or dirt buildup that could affect the flow of water when you turn your system on. If any valves, nozzles, or sprinkler heads look damaged, now is the time to replace them! When you are ready to test the system, make sure the pressure is set to an acceptable range and open the main valve slowly to avoid an initial high-pressure surge that could damage your pipes and/or valves.

If you don’t have a sprinkler system, you probably still have a garden hose. Hopefully you emptied it and stored it inside over the winter, but if not, no problem! You can check now for any cracking or leaks and repair them with a patch kit. Ideally, you’ll store it out of direct sunlight during the warmer months to keep additional cracking to a minimum.

Give your windows a little extra attention

Window washing may already be on your list, but don’t forget to clean the window sills, tracks, and screens, as well. Aside from the nice appearance, clean tracks and sills may help keep pests away and discourage mold growth. And of course, screens do their job best when they are in good shape.

To clean window and sliding door tracks:

- Vacuum out as much dry dirt and debris as you can

- Spray a cleaning solution and let it sit for a few minutes

- Use a small brush or sponge to clean out tough-to-reach spots

- Gently rinse the area, if needed, and wipe off the residue by hand with a cloth

- If you see any evidence of mold, call a professional!

To clean your screens:

- Remove them from the frame

- Use mild, soapy water and a cloth, sponge, or brush to gently scrub the screens

- Rinse your screens and dry them completely

- Replace the screens into your frames!

Clean out your major “cleaning” appliances

You may think your dish and clothes washers stay pretty clean because, well, that’s what they do. But these machines can actually get very dirty indeed, just from the sheer amount of use they get. Spring is the perfect time to give your major appliances a little TLC, so clean out your dishwasher filter, give the drain pump filter on your washing machine a good rinse, and do a deep clean of your dryer’s lint trap, exhaust hose, and outside vent.

These chores take less time than you would think, and they help your appliances to run more efficiently and use less energy, possibly lowering your bills! In the case of your dryer, it can also avoid turning your home into a giant fire hazard. To get a full clean, wash out your machines with hot water and vinegar too or buy a dedicated cleaner to run through an empty cycle.

Do some spring maintenance on your fireplace

Did you relax by a picturesque, roaring fire this winter? Then you’ll probably need to add your fireplace and chimney to the list.

The fireplace is mostly a matter of elbow grease. If you choose to do it on your own, it can be a messy task, so lay out a covering and wear old clothes and a dust mask as you work! Wait until the fireplace is completely cooled after your last fire of the season and sweep the dust, soot, and ash into a bag or trash bin. Then use a brush attachment on your vacuum to remove any remaining bits from the corners and edges. Finish up with a deep scrub, but make sure you use a cleaning solution that’s suitable for your fireplace’s particular material.

Chimneys can be tricky—although you can maintain them yourself if you are comfortable. Regardless, they should be cleaned (or at least inspected) annually for safety.

Clear your gutters and downspouts

Clean gutters direct water away from your roof, house, and foundation. But unless they are cleared out during certain times of the year, leaves, dirt, and twigs can clog the system. That could lead to pooling and, eventually, water damage to your home. A good cleaning before the spring rains come in should keep everything flowing where it’s supposed to.

After you empty any debris that has accumulated in the gutters, pour some water through the downspout to check for clogs. If the water doesn’t come out on the other side (or only trickles through), seal the top around your hose and turn it all the way on. The pressure should send your clog right out! If not, you can try removing it by hand or with a plumbing snake.

Want to know what else you can do?

These overlooked spring maintenance tasks may not be the first things you think of as a homeowner, but they’re an important part of keeping your home clean and safe throughout the year. For more spring upkeep ideas on your home, check out our guides to early spring lawn care, getting your air conditioner ready for action, and deciding whether your roof is due for a replacement or repair.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link